A private health fund is an insurance company that manages and administers private healthcare plans. Individuals and businesses can choose from a range of private healthcare plans, each with its own set of benefits. For natural therapy services, such as Traditional Chinese Medicine, massage, chiropractic care and acupuncture, you may be eligible to receive a private health insurance rebate depending on the extent of your coverage.

There are so many health funds available out there and the sheer number of policies available means that it can be daunting to find the right one for you. We've tried to make it easier for you with this comprehensive guide.

Choosing a Health Fund

The first and most important thing to consider when choosing a health fund is what you need your health fund to cover you for. Will you just need private hospital cover or will you also need an extras policy in addition to cover a range of services provided by complementary therapists? Make sure you select the right coverage for your healthcare needs and health insurance premiums that fit your budget. If you are having trouble choosing the right cover, there are websites available that will allow you to compare different health insurance policies. Insurance brokers are another option.

All these tools will help you to be covered for the things that you need and exclude the things that are likely to be nothing more than a waste of money. You can also opt to pay an excess or not. An excess is your out-of-pocket costs when you go into hospital – for example, $500. The higher the excess, the lower your private health insurance premiums will be.

When choosing, find out what therapies are covered and what limits apply. Limits usually apply to complementary therapies and there is often an annual limit of how much you can spend. Find out if this limit is per policy or per person.

You have the option to change health funds at any time. You are also able to change the level of cover that you have at any time, should you decide that your cover is wrong for you. However, if you change to a higher level of cover, you may have to serve additional waiting periods before you can claim benefits.

Regularly evaluate your health cover to ensure that it is suitable for your stage of life.

Benefits of Joining a Health Fund

A health fund has many benefits for you as the user. Being covered by a health fund means that you have the right to be treated in a public or a private hospital as a private patient. You are able to choose your own doctor, what hospital you are treated in, and a time for treatment that suits you. However, if it is emergency treatment, the previous may not apply until you are stable and past the period of emergency.

Health funds will also cover you for services that are not covered by Medicare. These include general services such as optical, dental and physiotherapy, but many health funds are adding a wide range of natural therapies to the services that they cover, allowing you to use your fund in times of health as well as sickness. Membership to a health fund may allow you to access services that you otherwise would not be able to afford.

Be aware that if you should choose not to join a private health fund for whatever reason, you still have the right to access the public hospital system through Medicare.

Services Covered by Health Funds

What you are covered for by your health fund depends on the level of cover that you choose to take out. Most health funds will have a range of cover options – from basic cover to a top cover that has all the bells and whistles.

If you select hospital cover, you are covered for some or all of the costs of being a private patient in a public or private hospital. The hospital costs you are covered for depends on the level of hospital cover that you purchase as well as the doctor and hospital that you choose and the agreement that you have with your health fund.

Ancillary cover, commonly known as extras cover, is also available at most health funds. This covers you for services that are performed outside a hospital and that are not covered by Medicare. A general indication of these services may include:

- Dental

- Ambulance

- Chiropractic

- Optical

- Speech therapy

- Occupational therapy

- Physiotherapy

- Complementary therapies (see later section for more information)

The type of extras cover available, like hospital cover, ranges from basic, to top of the line. Most health funds offer packages that combine hospital and extras cover. Alternatively, you are able to take out extras cover with a different health fund to what you have your hospital cover with.

Be aware that private health insurance does not cover medical services that are provided outside of a hospital and that are covered by Medicare – such as GP visits and specialist consultations. Private health insurance may not cover the total cost of your medical expenses, leaving you with an out of pocket expense in some cases.

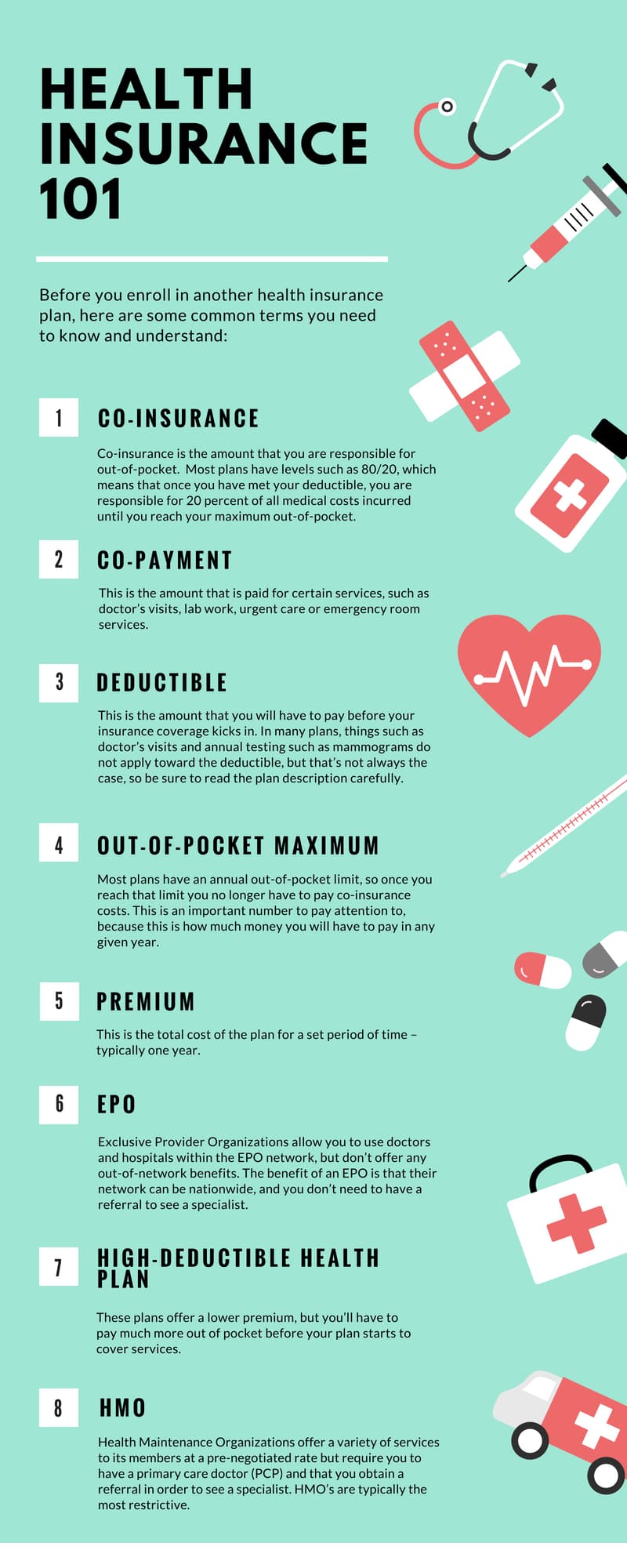

Source: Avenue Advisors, LLC

Complementary Therapies and Health Funds

Health funds are increasingly becoming aware of the benefits that are offered by alternative therapies and are adding many of these therapies to the list of services that they cover under their ancillary or extras cover. For details on the alternative therapies that are covered by your particular health fund, you will need to contact them for that information.

Extras cover is increasingly including items such as:

- Acupuncture

- Remedial massage

- Myotherapy

- Chinese herbal medicine

Health funds are also becoming of benefit in times of health. For example, you may be able to claim portions of your gym membership, quit smoking therapies, or even sporting equipment. Health funds are recognising the value of investing in people's health.

Health Fund Waiting Periods

When you join a health fund, you may have to wait a predetermined amount of time before you are allowed to claim benefits. This amount of time often varies according to the type of benefit being claimed. The typical waiting period for general dental is six months and twelve months for major dental. You will have to ask the health fund what waiting periods they have. In some cases, a health fund will have a promotional offer in which waiting times for certain therapies are reduced or even eliminated.

Waiting periods are imposed by health funds to ensure that people cannot join a health fund specifically to claim on a medical condition and then leave the fund after it has paid out. This type of behaviour increases premiums for everyone.

If you have a pre-existing health condition before you take out private health insurance cover, you will have to serve a waiting period before you can claim on items that are related to that health condition. Generally speaking, this is twelve months, although you should check with your fund for more specific information.

The 30 Percent Rebate and Lifetime Health Cover

You may be thinking that health insurance is something that only people on a good wage can afford. This is not necessarily the case. In 1999, a 30 percent rebate was introduced on health cover, causing private health fund memberships to increase by 50 percent.

Premiums do increase due to a number of factors but the rebate makes health insurance much more affordable.

Lifetime health cover is another initiative that was introduced by the government to help make health insurance more affordable and equitable. People that join a health fund before the age of 30 do not have to pay anything more. After the age of 30, the cost of the premium increases by 2 percent for every year. Say a premium is a flat $100 per month. This is what it will be for a 28 year old. In contrast, a 40-year-old that has just taken out health cover will have to pay $120 per month on the exact same premium. Therefore, it is to your advantage to take out health insurance as early as possible.

The Medicare Levy Surcharge

If you are eligible for Medicare and earn an annual income of more than $50,000 for singles and $100,000 for couples/families (family income is adjusted by $1,500 per year for each child after the first), you are required to pay the Medicare Levy Surcharge if you do not have appropriate private health insurance. This surcharge is one percent of your income.

Whether you choose to have private health insurance or not, you will still have to pay the Medicare Levy each year. This is because people with private health insurance still have the option to use Medicare or their private health insurance. Private insured patients still rely heavily on Medicare services and it is only fair that everyone pays the levy.

Originally published on Jan 25, 2009